USD/JPY Slides after the 2023 Highs as Japan’s Inflation Remains Elevated

USD/JPY Analysis

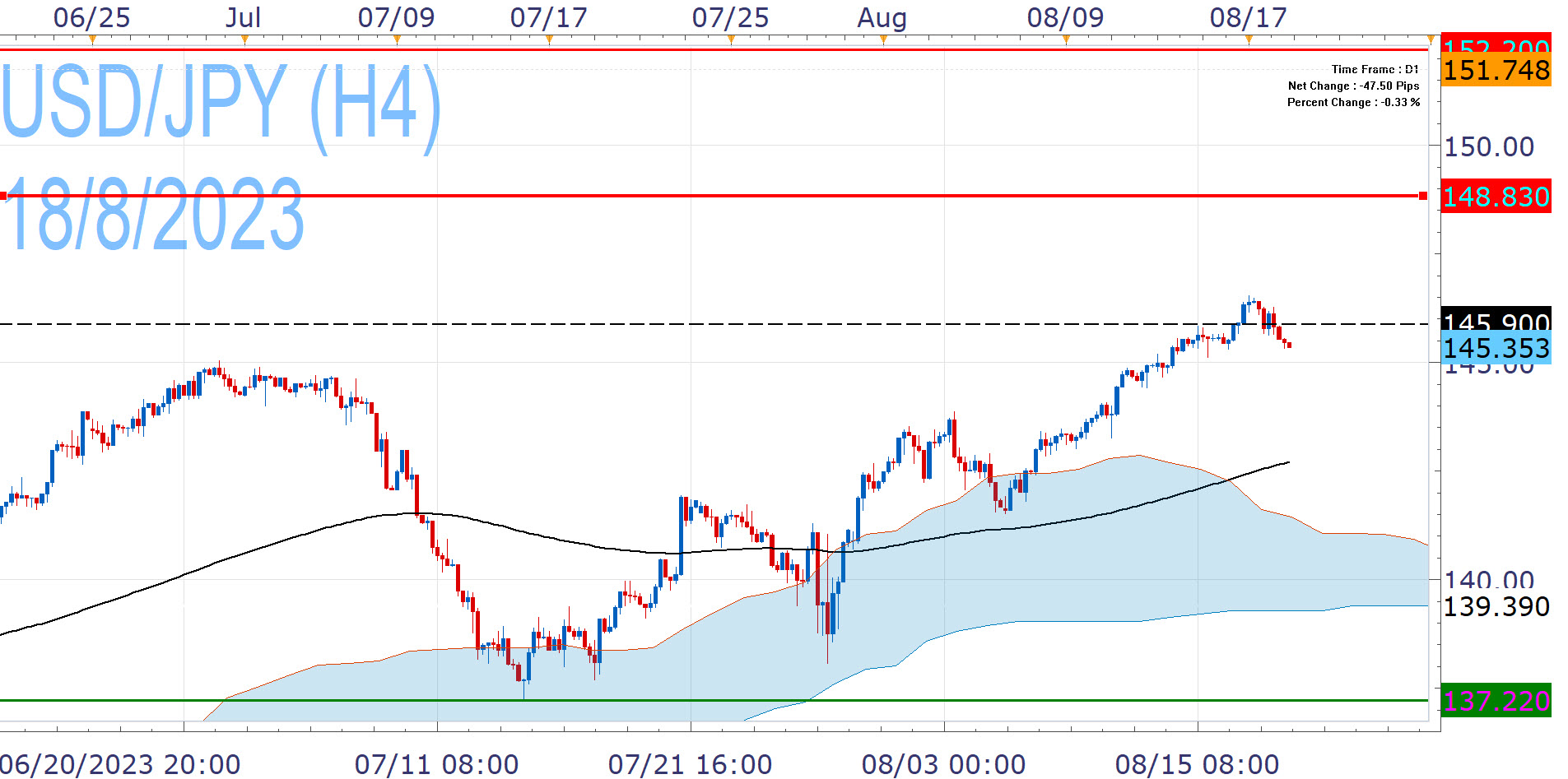

Wednesday's minutes from the Fed's July meeting (0.25% hike) had a hawkish tilt and kept the door open to more hikes, showing that "most participants" still see upside risk to inflation, which "could require further tightening" of the monetary policy [1]. Coupled with strong retail sales, industrial production and overall resilient economy, they helped USD/JPY to new 2023 highs.

It pulls back from those highs though, as it also moved into the levels (dashed line) that had prompted Japanese authorities to steep in the FX market in support of the Yen, nearly a year ago. This crates some caution for new intervention, verbal or actual.

Today's CPI report from the country sustains the pressure, since core-core inflation ticked back up to 4.3% y/y, matching the May reading and the highest since 1981. CPI ex-fresh food eased to 3.1% y/y, but stayed above the 2% target for eleventh straight month.

The Bank of Japan raised its FY2023 forecast for CPI ex-fresh food, to a median of 2.5% (from 1.8% previously) [2], but still thinks there is more work needed. Policymakers believe that "sustainable and stable achievement" of the 2% target "has not yet come in sight". [3]

Today's inflation figures do keep pressure for an exit from the ultra-loose policy setting that has been detrimental to the Yen, but they are not strong enough to compel the BoJ to change its ways. Officials did take another step towards policy normalization in July, since they essentially loosened the yield curve control, but this maneuver also allows them to maintain their dovish stance for longer.

USD/JPY slides further today as it hovers around intervention levels and markets still look for policy normalization by the BoJ. This creates scope for a correction towards the EMA200 (142.70-80), but the downside is well protected and daily closes below it have a high degree of difficulty.

Bulls are in control though, and have the ability to challenge 148.83. The hawkish Fed minutes keep more tightening in play and markets adjust to prospects for prolonged restrictive stance, while the policy differential continues to favor the greenback.

Nikos Tzabouras

Senior Financial Editorial Writer

Nikos Tzabouras is a graduate of the Department of International & European Economic Studies at the Athens University of Economics and Business. He has a long time presence at FXCM, as he joined the company in 2011. He has served from multiple positions, but specializes in financial market analysis and commentary.

With his educational background in international relations, he emphasizes not only on Technical Analysis but also in Fundamental Analysis and Geopolitics – which have been having increasing impact on financial markets. He has longtime experience in market analysis and as a host of educational trading courses via online and in-person sessions and conferences.

References

| Retrieved 18 Aug 2023 https://www.federalreserve.gov/monetarypolicy/fomcminutes20230726.htm | |

| Retrieved 18 Aug 2023 https://www.boj.or.jp/en/mopo/outlook/gor2307a.pdf | |

| Retrieved 29 Apr 2024 https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2023/k230728a.pdf |

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.