Language Processing Platforms and Forex Trading

AI and Language Processing

In recent years, AI has made amazing progress in understanding and using human language. AI language processing has changed how computers interact with us. It can translate languages, analyse feelings in texts, create chatbots, and help us in many industries. AI and language processing have transformed our world, opening new ways for computers and people to work together.

In this article we explore two language processing platforms that will be useful to the retail trader: ChatGPT and Capitalise.ai.

1. ChatGPT

ChatGPT, created by OpenAI, is a significant change in language processing and AI. Unlike Traditional AI, Generative AI applications like ChatGPT, create text and other types of content in response to prompts. ChatGPT can chat like a real person, answer questions, and do many language-related things. With its advanced AI abilities, ChatGPT can change industries and make it easy for businesses and people to use AI effortlessly.

Remember, while ChatGPT can be a helpful resource, forex trading involves inherent risks, and no AI or model can guarantee profits.

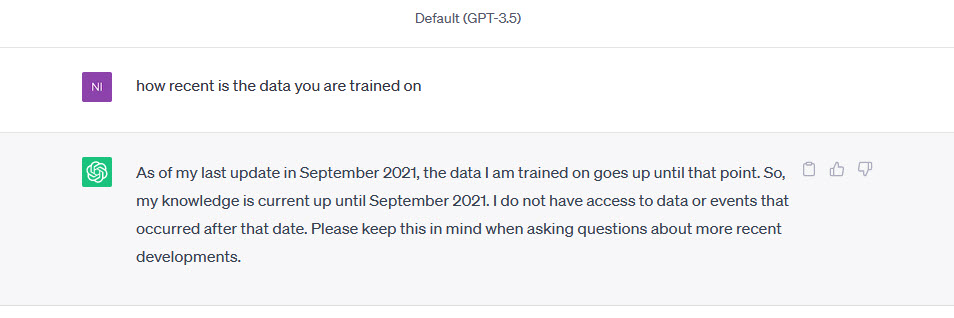

There is little doubt that the potential for ChatGPT and AI in the forex industry is huge. However, currently ChatGPT is limited because it has no access to real-time data and its responses are based on information up to September 2021.

Source: OpenAI's ChatGPT

This means that currently ChatGPT can help traders with:

i. Educational resources

ii. Historical data analysis

iii. Risk management tips

iv. Forex news and trends

v. Emotional discipline

vi. Technical analysis

vii. Strategy development

i. Educational Resources

ChatGPT can provide explanations and insights into forex trading concepts, terminology, and strategies. Whether you are a beginner or an experienced trader, it can offer a wide range of information to enhance your understanding of forex markets.

ii. Historical Data Analysis

While ChatGPT cannot analyse current data, it can help you interpret historical forex data and identify patterns and trends. Analysing past market behaviour can offer valuable lessons and inform your trading decisions.

iii. Risk Management Tips

Proper risk management is crucial in forex trading. ChatGPT can provide guidance on risk management techniques, including position sizing, setting stop-loss levels, and managing overall portfolio risk.

iv. Forex News and Trends

Although it cannot provide real-time news updates, ChatGPT can still discuss past market trends and significant events that may have influenced forex prices. This information can help you understand how markets have reacted to various factors historically.

v. Emotional Discipline

Forex trading involves managing emotions, such as fear and greed. ChatGPT can offer advice on maintaining emotional discipline and making rational decisions in the face of market fluctuations.

vi. Technical Analysis

While ChatGPT cannot analyse real-time technical indicators, it can explain various technical analysis tools and concepts. This knowledge can help you interpret technical data on your trading platform.

vii. Strategy Development

ChatGPT can assist you in brainstorming and refining trading strategies based on historical market conditions and performance. It fosters exploration of different approaches and their potential effectiveness.

What is more, it can provide Python algorithms for automating such strategies. However, one still needs some level of programming knowledge as implementation of such algorithms is not a straightforward process.

2. Capitalise.ai

Capitalise.ai is an AI tool tailored for traders, offering text-based solutions for market analysis, monitoring, and trading automation. Although it shares similarities with ChatGPT, Capitalise.ai is uniquely designed for trading purposes. It uses plain English commands, converting them into detailed algo trading strategies. The software enables traders to automate their trades with algorithmic models, regardless of their technical expertise. This user-friendly approach empowers traders to take advantage of automation, even without a strong technical background.

With Capitalise.ai, you can use any indicator available on the charting platform to trigger your automated trading strategies. Once the set conditions are met, the software will automatically execute your trades. Moreover, it can keep you informed through mobile alerts or emails.

Capitalise.ai allows you to:

i. Automate your trade entries.

ii. Automate your trade exits.

iii. Automate both entries and exits under various scenarios.

iv. Create ongoing strategies.

You can find more information on Capitalise.ai here.

OpenAI is an AI research and deployment company.

FXCM is an independent legal entity and is not affiliated with Capitalise or OpenAI. FXCM does not endorse any product or service mentioned above. Nothing associated with this article shall be considered a solicitation to buy or an offer to sell any product or service to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the laws or regulations of such jurisdiction.

FXCM Research Team

FXCM Research Team consists of a number of FXCM's Market and Product Specialists.

Articles published by FXCM Research Team generally have numerous contributors and aim to provide general Educational and Informative content on Market News and Products.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.