EUR/USD Runs a Solid Week, Sticks to Familiar Pattern

EUR/USD Analysis

The pair had managed to strengthen after last week's historic 0.75% rate hike by the Fed, since the move was already priced in by markets, but it was unable to close the week with profits.

During his Senate testimony yesterday, Mr Powell reaffirmed the bank's resolve to bring inflation down, pointed to more rate increases and said that officials "want to have a restrictive policy" [1]. However, his remarks did not add anything new or more hawkish and EUR/USD was once again able to benefit.

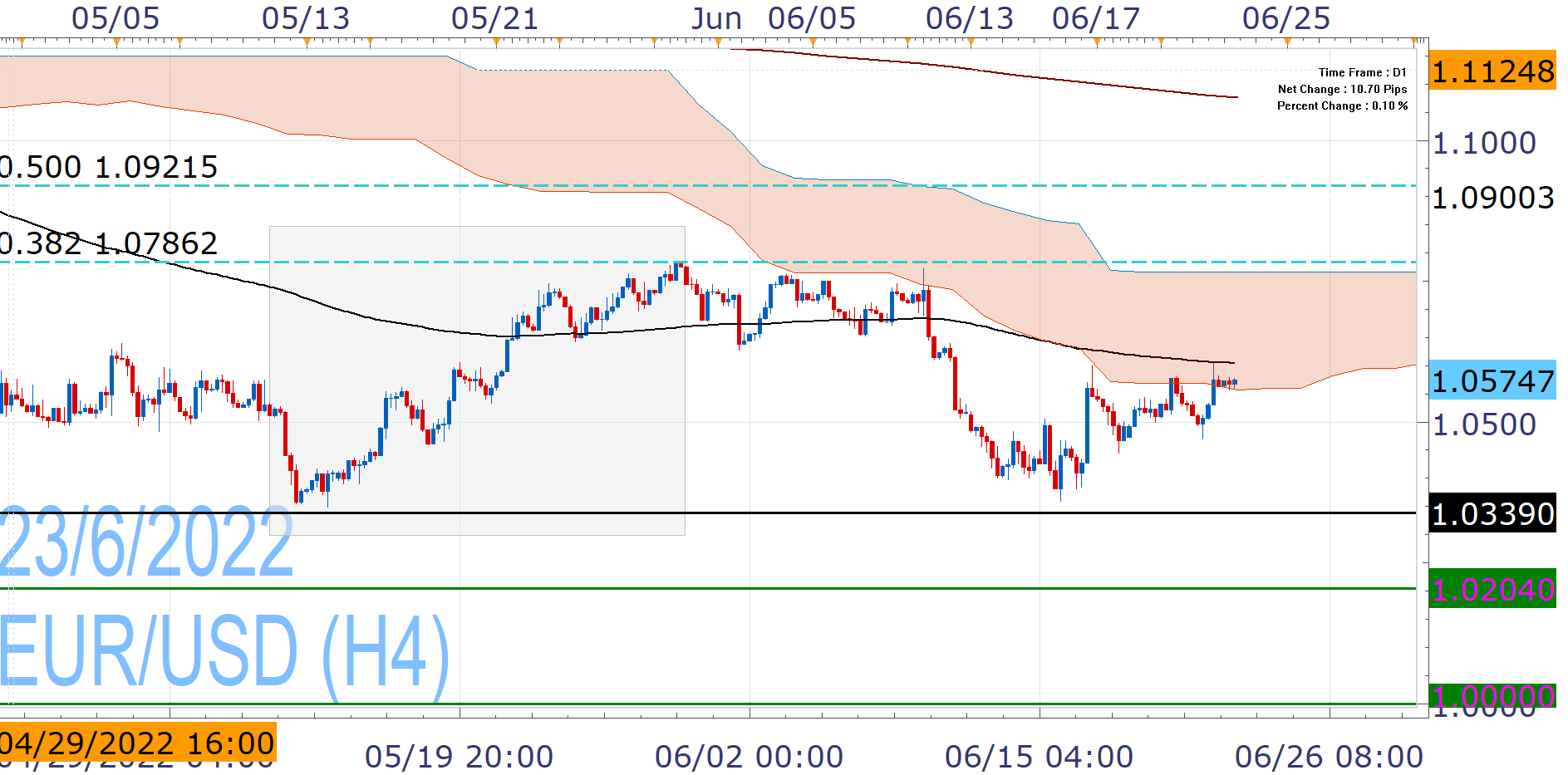

The common currency has staged a recovery this week, after having defended the 2017 lows (1.0339) once more and tries to move past the EMA200 (black line). The current price action looks very familiar, since it resembles the activity of the second half of May.

If recent history is a guide, then we can see further strength past the EMA200 that would again test the 1.0765-87 area and pause downward bias. However, this region includes the well-established 38.2% Fibonacci of the 2022 High/Low drop and the upper border of the thick daily Ichimoku Cloud and we still struggle to see what could send it convincingly beyond these levels.

Despite the ECB's recent hawkish pivot, which now expects interest rate-lift-off in July, the US Fed remains more aggressive and the monetary policy differential is still unfavorable for the common currency.

The technical outlook has not changed much, since the EUR/USD runs another losing month. The risk of new multi-year lows (1.0339) has not gone away, although sustained sub-1.0200 moves have a higher degree of difficulty for now.

Markets now turn to the second day of testimony form Fed Chair Powell and series of Preliminary PMI for Eurozone and USA.

Nikos Tzabouras

Senior Financial Editorial Writer

Nikos Tzabouras is a graduate of the Department of International & European Economic Studies at the Athens University of Economics and Business. He has a long time presence at FXCM, as he joined the company in 2011. He has served from multiple positions, but specializes in financial market analysis and commentary.

With his educational background in international relations, he emphasizes not only on Technical Analysis but also in Fundamental Analysis and Geopolitics – which have been having increasing impact on financial markets. He has longtime experience in market analysis and as a host of educational trading courses via online and in-person sessions and conferences.

References

| Retrieved 27 Apr 2024 https://www.banking.senate.gov/hearings/the-semiannual-monetary-policy-report-to-congress |

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.